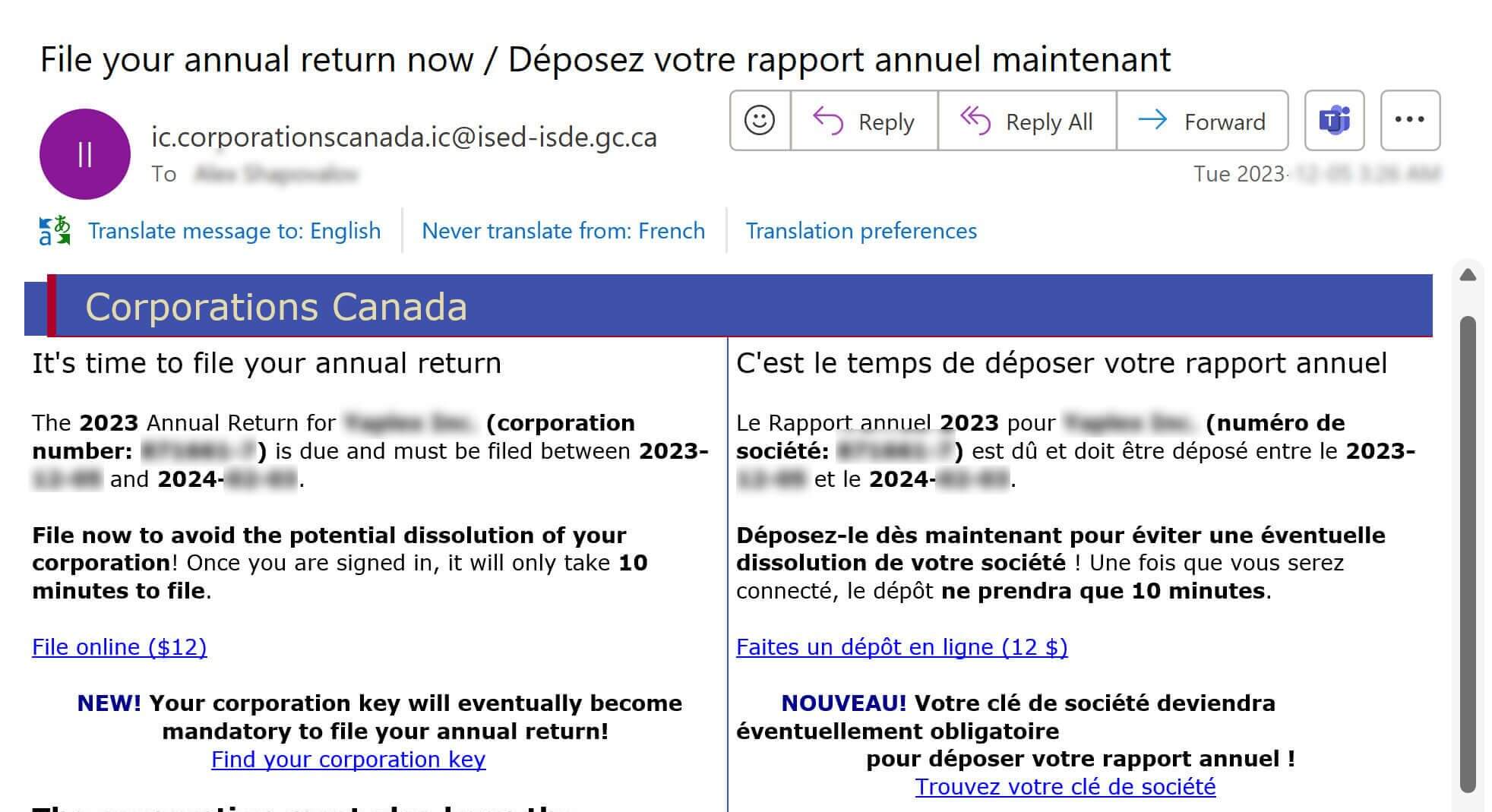

Is the image you see below familiar to you? That is a screenshot from an email that reminds you to file an annual return for your corporation. As a business owner, you probably receive that email from Corporations Canada every year after your corporate anniversary date, and it is important to act on it. Some business owners ignore it, and some ask their accountants to explain. However, your responsibility as a business owner (or director) is to take care of annual return filing to keep your corporation in good shape.

In this article, I explain what the annual return is, why it should be distinct from a corporate tax return, how to file it, and what happens if you forget to do so.

Are you looking for an accountant for your corporation?

We are a full-service accounting firm and provide bookkeeping and corporate tax services to small business owners. Let us know if you need an accountant or want to change an accounting firm. We offer high-quality personalized accounting services to small businesses and medium-sized corporations.

Table of Contents

What is an annual information return?

What is the difference between Annual Return and Tax Return?

What is the annual return filing deadline?

What happens if you do not file an annual return?

How much is the fee to file an annual return?

How do you file a federal annual return?

How do you file an Ontario annual return?

Common Mistakes to Avoid

Frequently Asked Questions (FAQ)

The best accounting solution for business owner

What is an annual information return?

Every corporation has to file an annual return with Corporations Canada (in case of a Federal corporation) or the Provincial business registry (in case of a provincial corporation). But what is the “annual return”? What role does it play in your company?

Firstly, an annual return is a way to tell the government of Canada that the corporation is active and to confirm that somebody is working in the company or taking care of it. That is to avoid a situation when a corporation becomes abandoned due to inactivity or if something happens with the owner (for example, in case of death).

Secondly, filing annual returns ensures the most up-to-date information about the corporation exists in the online database of federal corporations. When you file the annual return, you provide your corporation’s updated list of directors and the most recent address, which will be publicly available on the Corporations Canada website.

What is the difference between Annual Return and Tax Return?

| Annual return | Corporate tax return | |

| Requirements | Canadian corporate law | Canada Revenue Agency (CRA) |

| Purpose | Notify the government that the company is active and provide the most recent information. | Inform CRA of the corporate income and tax obligations. |

| Responsible | Business owner | Accountant |

| Cost | Low or free | High (depending on the accounting firm you work with) |

| Time to file | About 15 minutes | About a week (depending on how fast you can provide all the required information) |

What is the annual return filing deadline?

Federal Canadian corporations are required to file annual returns within 60 days after the corporation anniversary date. Typically, your anniversary date is when you opened your company; you can find it on your certificate of incorporation. Still, in some cases, you can change the anniversary date during the first year when filing your first tax return. If you are unsure what your anniversary date is, you can find it in Corporations Canada’s online database.

If you have a provincial corporation, double-check the deadline with the provincial business regulator because the deadlines vary for different provinces.

What happens if you do not file an annual return?

If you forget to file an annual return for your corporation, you risk getting your corporation dissolved, meaning the corporation will become “inactive.” As a result, you can’t conduct business anymore, and your clients or suppliers can’t work with you (it is easy to validate whether the company is active). That may not necessarily happen if you forget to file an annual return for the first year. Still, if you don’t submit the corporation’s annual return for two or more years, the corporation will be dissolved automatically. You may not even know about it.

That may be fine if your company is indeed not active. Yet, if you conduct business and forget to file the annual return, the damage that results in automatic dissolution may be very significant.

Dissolved corporation’s obligation to CRA

When your corporation is automatically dissolved, it does not free you from other obligations, for example, the obligation to file your corporate taxes. If you do not have any income or expenses, you still have to file a nil corporate tax return, and once your corporation is dissolved, you need to file the Final Corporate Tax Return.

We recently had a client who wanted to file a nil return with the CRA for the last three years, but once we started working, we noticed that he forgot to file the annual return. As a result, his corporation was automatically dissolved without his knowledge, so instead of filing multiple nil returns with CRA, we have to file nil returns and a Final Tax Return, which you file after the dissolution of your corporation.

Nil Corporate Tax return preparation

When your company has no income or expenses, you still have to file an annual return and a Nil Corporate tax return.

Our company can help you with the Nil return preparation and filing. Our services are quick and affordable, and that is a small price to pay to keep your corporation in a good state.

How much is the fee to file an annual return?

Fling annual return fees are different depending on the type of corporation you have. Filing a federal corporation annual return is $12 (online) or $40 (by email or regular mail) per year.

Provincial filing depends on the province, but in the case of Ontario, that is free. Ontario annual returns can be filed online (processed immediately), by regular mail (processed within 15 days) or by email (processed within seven days).

That is a small price to keep your corporation active and in a good state.

How do you file a federal annual return?

Filing an annual return for a federal corporation is an easy online process which generally should not take more than 15 minutes. In the past, it was even faster as it did not require GCKey, but recently, the government of Canada implemented new security measures that require you to sign in with GCKey.

Once you have your GCKey, you need the following information to file:

- Corporation name or business number

- The “date of your last annual meeting” is when all shareholders meet to review financial statements and auditor’s reports and elect directors. If you are the only director, you can choose any date within the 60-day deadline, which will be your annual meeting date.

- You need to know if your corporation is distributing or non-distributing. It is most likely a non-distributing corporation, meaning you do not publicly trade your company’s shares on the stock exchange.

- To file a return, you need to be either:

- Director of the corporation

- An officer of the corporation, appointed by directors – someone who manages the day-to-day operations, for example, president, treasurer, secretary

- An authorized individual is a person who is authorized by directors and has relevant knowledge of a corporation; for example, a lawyer.

You can start the process from the Online Filing Center page, where you can access various business services provided by the Canadian government.

Another option is to click the link in the email you receive as a reminder to file an annual return.

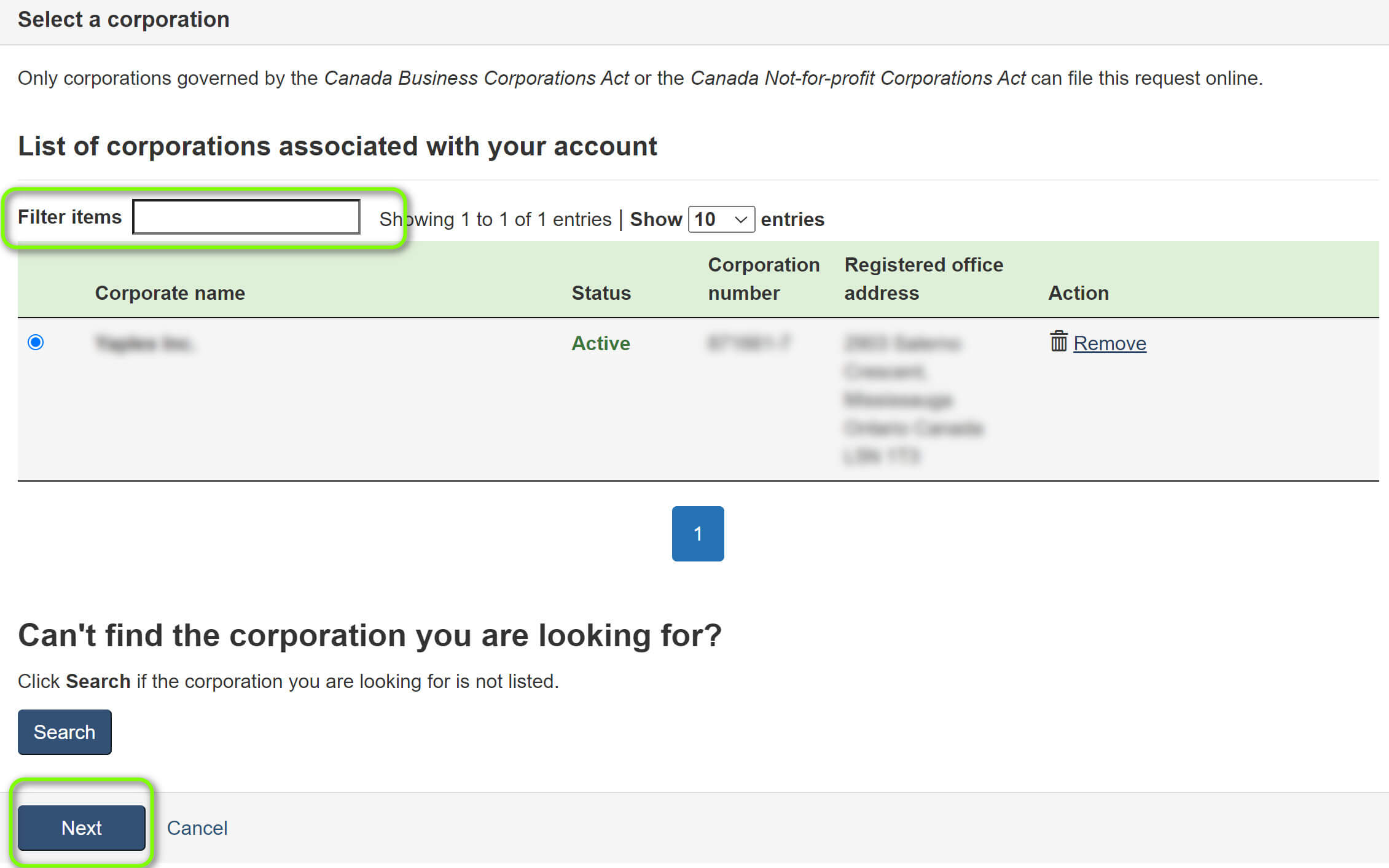

Once you log in with GCKey, you need to find the corporation for which you are filing a return; you can use the corporation’s name or business number.

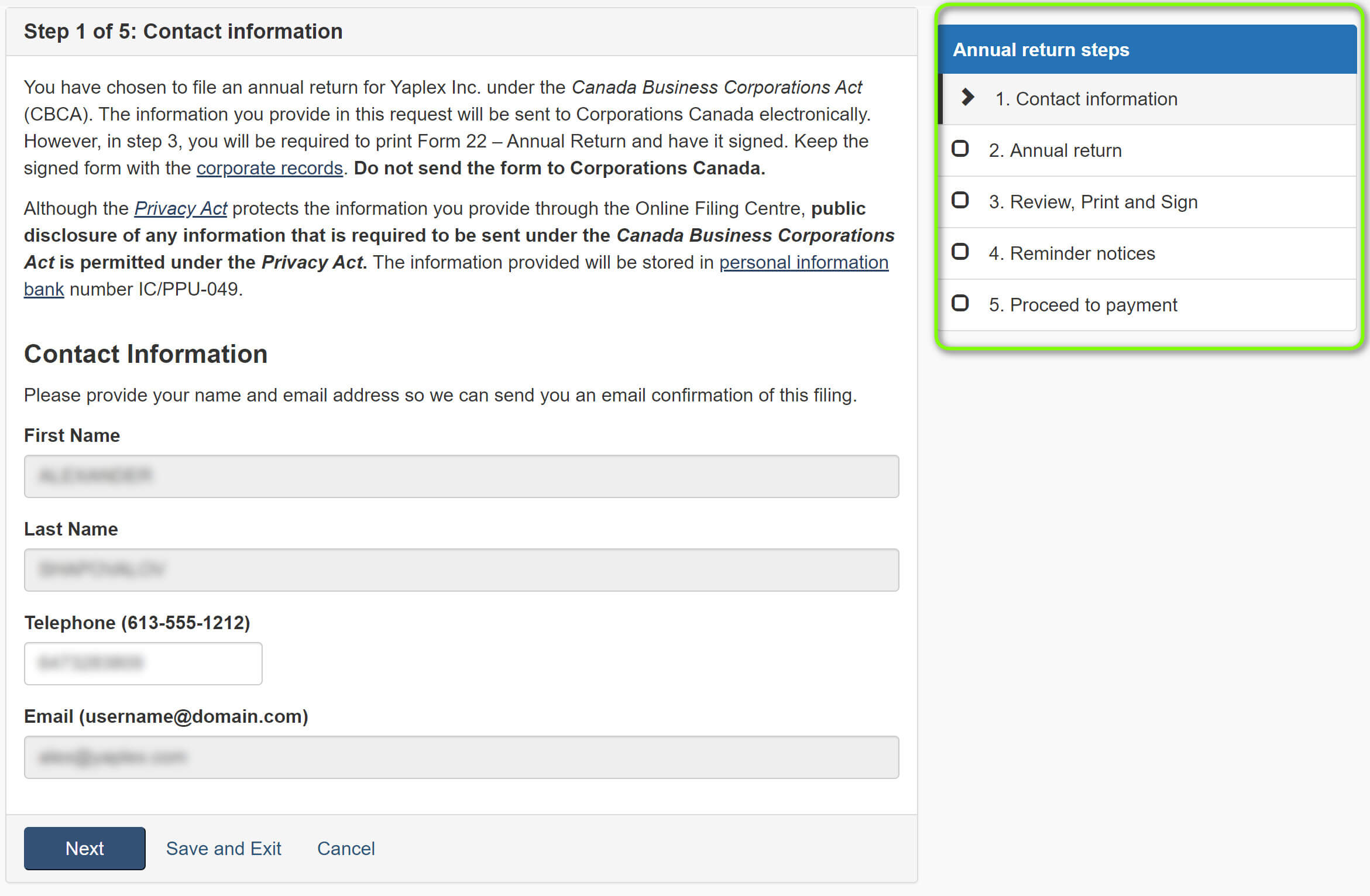

Contact information

In the first step, you must provide your contact information, such as name, email, and phone number.

Annual return

In the second step, you need to provide the date of the last annual meeting, information on whether the corporation is distributing, and electronically sign the return.

Review, Print and Sign

Then, you can review and print your Form 22 Annual Return and save it for reference.

Reminder Notices

In the reminder step, you choose which email address to use as a reminder for the following year’s filing. By default, it will come to your email address, but you can add extra people who need to receive it. If you have a few directors, you can add all of them, or if you have a shared email address, that will also work.

Proceed to payment

The final step is to pay your fees. You can use a credit card. The payment is a business expense, which is deductible, so we suggest using a business credit card.

How do you file an Ontario annual return?

The process is similar if you have a provincial corporation, but you need to find all the information on the provincial website. You can start at the Ontario Business Registry website if you have an Ontario corporation.

Please refer to provincial or territorial business registry websites for provinces other than Ontario.

Common Mistakes to Avoid

The process of filing a corporate annual return is very straightforward. However, pay attention to the following items where most people make mistakes:

- Missing deadlines is the most common mistake when you forget or ignore the annual return filing deadline; in that case, you risk your corporation being automatically dissolved.

- Avoid filing due to inactivity – even if your corporation is inactive, you still have an obligation to file an annual return. However, if you are no longer operating the corporation, you can dissolve it and file a final tax return to CRA. Dissolving means that you legally terminate its existence.

Our company helps with federal corporation dissolution, and we can prepare and file a Final tax return to CRA, which will let CRA know that the corporation is closed and they should not expect any tax returns from it.

- When you mix “distributing” and “non-distributing” terms, a distributing corporation trades stocks on the stock exchange; that is typically a public corporation, and anybody can buy its stocks. Small business owners are usually “non-distributing” corporations, which has nothing to do with selling goods or services or delivering products to your clients.

Frequently Asked Questions (FAQ)

Should I pay someone to file an annual return?

Many companies offer to submit an annual return for you; usually, they charge around $300 – $500 per return. While it is up to you to decide if you need such help, we suggest you do it yourself. The process is easy and will cost you only $12 and about 15 minutes of your time.

Hire a professional accountant for your business at Taxory!

When it is time to file your corporate taxes to CRA, you need a reliable and experienced accountant who can do it for you. At Taxory, we offer Bookkeeping, Accounting and Tax services for business owners who don’t have an accountant on the payroll. Use the form below to get in touch, and somebody from our team reach out to you as soon as possible.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Anna Grigoryan is a professional corporate accountant who provides accounting, bookkeeping and tax services to Small Business owners and individuals. She has more than ten years of professional experience in public accounting and a bachelor’s degree in Business Accounting. Anna is the CEO of Taxory, an accounting firm in Toronto area.